EtherDelta Smart Contract Trading: Complete Guide & Review

Table of Contents

EtherDelta is a cryptocurrency exchange for ERC-20 coins and ETH trading pairs. The exchange operates as a decentralized exchange that runs on smart contracts that manage wallet integration, deposits, and withdrawals.

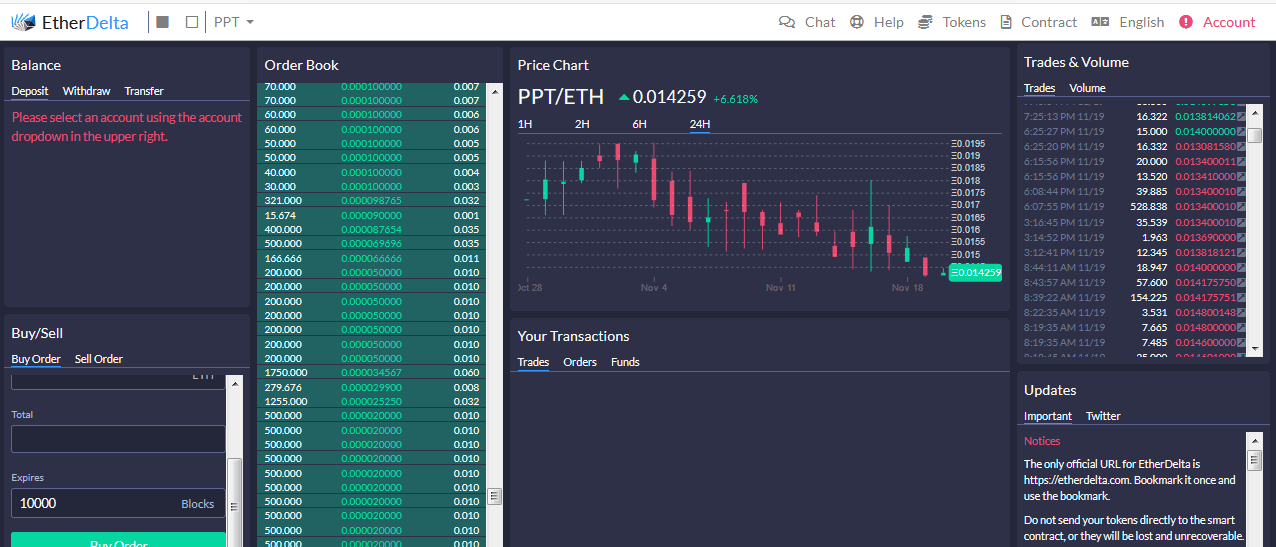

See below an image of EtherDelta showing the user interface.

Though a lot of efforts have gone into crafting anonymous cryptocurrencies such as Monero and Zcash, the user’s transaction details can easily be exposed when trading in the centralized exchanges, such as Poloniex, because they strictly follow know your customer (KYC) rules.

The centralized exchanges require users to provide personal info in line with local laws to prevent fraud and compliance with tax regulations. But they have also become easy targets for attackers and made it easy for authorities to access user information. This is where EtherDelta smart contract trading becomes relevant as a decentralized solution.

This EtherDelta review is a comprehensive analysis of the decentralized exchange to establish how it addresses the issues affecting other exchanges such as high insecurity and lack of anonymity. The review seeks to answer the big question of “Is EtherDelta the platform that will help intensify blockchain adoption in the community?”

An Overview Of EtherDelta

The EtherDelta exchange was started in 2017 by Zack Coburn. Immediately after launch, EtherDelta became a favorite for traders because of its unique design of using smart contracts to manage trading via users’ wallets without requiring additional registration.

Investors and traders further liked the idea that EtherDelta was a point for accessing a lot of ERC-20 tokens especially soon after release via the initial coin offering (ICO). But the popularity waned towards the close of 2017 as other decentralized exchanges such as IDEX and Bancor emerged.

A case filed by the US Securities and Exchange Commission (SEC) against EtherDelta and its founder, Zack Coburn also saw more people opt to use different exchanges or simply wait and see how things unfold. But the woes of EtherDelta were far from over.

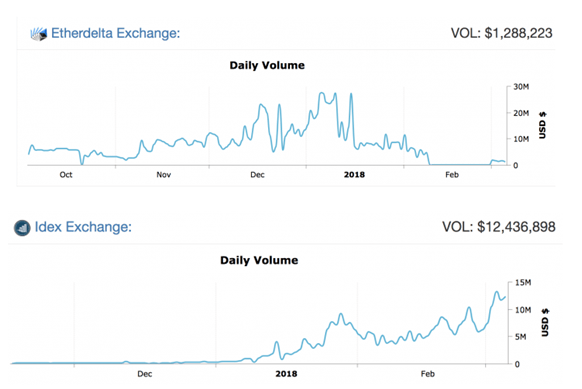

In February 2018, EtherDelta was forced to create a new decentralized exchange referred to ad ForkDelta. By early 2018, the EtherDelta volume plummeted as those of competitors shot up. Here is a comparison of EtherDelta performance with one of the top competitors referred to as IDEX.

How Does EtherDelta Work?

EtherDelta operates like a big smart contract that oversees most of the functions such as wallet integration, funds deposits, withdrawals, and trade orders execution. Because they are automated, it implies that the user is in control of the process.

Put it this way; the smart contract outlines the terms and conditions for trade and once the trader meets them, the system executes the orders automatically. EtherDelta smart contract trading follows this automated approach to ensure secure transactions. The following are the steps to follow to start trading at EtherDelta exchange.

Create An Account On EtherDelta

On the top right-hand corner of the EtherDelta interface, click “Account” to create a new account by generating public and private keys. The public key is your wallet address at EtherDelta while the private key will help to link with your coins such as OmiseGo or Pundi X.

Make sure to keep the private and public keys safely because their loss could indicate total loss of your coins at EtherDelta crypto exchange.

Transfer Your Tokens To Trade To EtherDelta Public Address

To trade at EtherDelta, you will need to transfer your coins from the current Ethereum wallet to the public address you have created in the first step. Some of the common Ethereum wallets include Trezor, MyEtherWallet, and Ledger Nano S. Make sure to send the exact number of coins you anticipate trading at EtherDelta.

Identify The Coin To Trade On EtherDelta

At the top of the EtherDelta cryptocurrency exchange, select the tokens that you want to trade. These can be ETH or most ERC-20-based coins such as ADT, BNB, and OmiseGo coins.

Transfer Your Funds To The EtherDelta Smart Contract

Now that you have transferred the coins to trade from your wallet to the EtherDelta address, you need to take another step of moving them to the Ethereum smart contract. On the “balance section”, there are three main columns for managing trading: deposits, withdrawals, and transfers.

The deposit column is for the token and quantity you want to trade, while the withdraw column shows the balance in your wallet. Under the transfers section is EtherDelta, which represent the smart contract that will execute the trade. The EtherDelta is the contract used to create buy and sell orders.

Execute Buy Orders

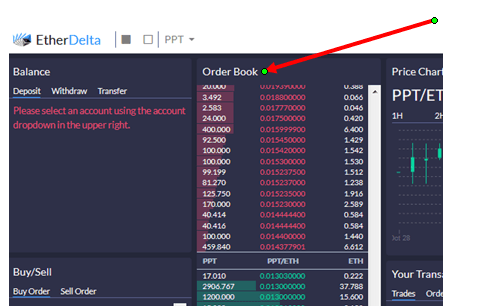

To buy the tokens of choice, you need to navigate to the “Order Book” and select the available sell orders listed on your selected token. For example, if you want to buy BNB using ETH, picking a ready order means that another person who wants to sell BNB for ETH has already listed an order. When you click buy, your ETH will be sent to the seller while your account will be credited with BNB.

An image below illustrates the EtherDelta Order Book.

Instead of using the already available orders that have been created by other traders, you could opt to create a “New Order” by filling in the coins you want to buy, at what price, and the total amount of ETH to be used. Once you hit buy, the order will be added to the EtherDelta Order Book.

NOTE: Placing your order can be tricky because you need to understand the current market rates to avoid understating or overstating your token price. If you need to place a new order, make sure the token trading info is correct.

Once you have completed the purchase, it is advisable to withdraw the tokens to your wallet. Though decentralized exchanges are considered more secure than centralized exchanges, it is better to transfer the coins to your wallet where you have full control.

This video is a demonstration of how to start trading at EtherDelta decentralized exchange:

The Trading Fees At EtherDelta

Placing an order on EtherDelta does not attract any charges. However, the taker will be charged a fee of 0.3% when an order is executed. The fee goes to supporting the exchange’s development and also paying miners who help confirm transactions on the platform.

Note that the payment is effected in GAS. This is the execution fee for transactions made on the Ethereum blockchain. The traders on the EtherDelta have the option to select the fee on the “Gas Price” section. If you set a higher gas price, the order will be implemented faster because more miners will be motivated to process it.

The following list is the default GAS prices for different transactions:

| Transaction | Fees |

| ~0.0003 ETH ~0.0001 ETH ~0.0001 ETH ~0.0002 ETH ~0.0003 ETH ~0.0002 ETH |

Note that there are no deposits and withdrawal limits on EtherDelta. You only need to observe the minimum transaction size of 0.001 ETH. Besides, an account can only have a maximum of 5 buy and 5 sell orders. These limitations ensure EtherDelta smart contract trading remains efficient and manageable.

Is EtherDelta Safe?

One of the primary aims for creating decentralized exchanges is enhancing the security of the traders. A closer look at the centralized exchanges reveals that they are an easy target for hackers. From the Mt. Gox hack of 2011 that saw over $460 million lost to the recent Coincheck attack that resulted to loss of about $500 million in tokens, the attacks took place in centralized exchanges.

When compared to these centralized exchanges, EtherDelta has implemented impressive features such as decentralized operations, personal wallet integration, multi-factor authentication, passwords, and use of smart contracts. Despite these efforts, EtherDelta was also attacked in December 2017.

The attack was a phishing scheme on the EtherDelta’s DNS server where the attacker supplanted a copycat version, resulting in the loss of 305 ETH $244,000 and several ERC-20 tokens. This attack has made some people opt to scale down or opt away from EtherDelta for other exchanges.

The attack at EtherDelta is a demonstration that despite every effort, no system can be 100% secure. Therefore, consider EtherDelta a safe exchange but operate with extra caution. For example, this EtherDelta exchange review recommends that you only move a small number of your tokens on the exchange for trading and withdraw them to your personal wallet immediately after the trade. Despite these risks, EtherDelta smart contract trading remains a more secure alternative to centralized exchanges.

The EtherDelta Customer Support

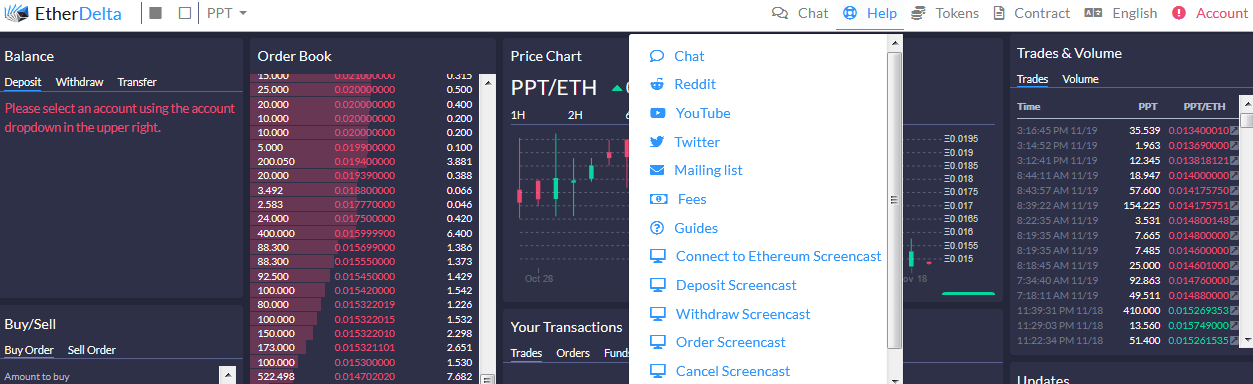

Unlike other exchanges, EtherDelta does not provide a frequently asked questions (FAQ) section on its website. Instead, it has a “Help” drop-down menu that provides users with helpful resources. Take a look at the image below outlining the resources.

These resources include a live chat that allows users to interact with EtherDelta company representatives. The issue with the chat is that it is a public chat-room. This implies that the conversations are visible to all people on the platform.

The guides on the resource direct users to different forums such as Reddit that provide more info about EtherDelta and how various features operate.

EtherDelta Review Summary

EtherDelta is a carefully thought and articulately implemented exchange that is helping to provide solutions to centralization issues such as the lack of privacy that have dogged the niche since inception in 2009. But it also has a number of challenges. Here is a summary of the pros and cons of EtherDelta.

Pros

- No additional registration apart from that of your personal wallet is needed.

- The exchange has a very impressive customer support.

- It is more secure than centralized exchanges.

- The platform is led by an aggressive team who is motivated to help grow the crypto niche.

- It lists a wide range of tokens for traders.

- The EtherDelta’s transaction fee is small.

- The exchange is a great option for investors targeting new tokens, especially after released through ICOs.

Cons

- The trading interface of the exchange is complex, especially for newbies

- The trade executes relatively slow compared to other centralized platforms such as Binance

- The platform only supports ETH and ERC-20 tokens.

While the creation of EtherDelta crypto exchange helped crypto enthusiasts get a sigh of relief for decentralizing trading, the emerging issues such as the DNS attack of December 2017 and stiff competition pose serious risks to its existence. For example, the traded volume has been on a downward trend as competitors rake bigger market share.

Despite these concerns, EtherDelta still remains an impressive platform for trading Ethereum-based tokens without involving centralised exchanges. Though the interface might be intimidating for newbies and only handles ERC-20 tokens, the feature and focus on security are impressive. Therefore, do not hesitate to use it.

However, it is important to exercise great caution when trading on the decentralized exchange. Some of these precautions include only using the platform when trading and immediately moving the coins to your wallet. Even with EtherDelta smart contract trading offering enhanced security, these practices remain essential.

You should also consider comparing EtherDelta digital coin exchange with other platforms such as Waves Dex and IDEX to see which one offers more benefits. The target should not be simply jumping to the trending platform, but rather selecting the exchange that is secure, has impressive features, and that lists a lot of crypto tokens.