The Advantages And Difficulties In Building Trading Platform Software Development

If you imagine a room full of yelling people when you hear the word “trading”, then you’ve stuck far away in the 80s. Those times are in the past due to Covid – 19 and all many other reasons. Nowadays, the things that took people hours and days take just a few minutes thanks to automatization processes. The desire to make trading processes faster has led to dynamic online trading platform development. In this article, we will revise the main features of trading platform software development and what difficulties may occur in the process of creation.

What Is a Trading Platform?

Trading platforms are the apps and websites created to make communication and work easier for traders, brokers, investors, and other stock market participants. Those platforms allow controlling different things at the same time. To cut a long story short, it will be helpful for both those who are interested in long-term trade and those who want to have just short-term trading.

The easiest way to classify trading platforms is to divide them into two types:

- The traditional-oriented type works with precious metals, stocks, currencies, etc. It’s the most wanted because all the trading market participants are familiar with its assets and understand how to work with them.

- Cryptocurrency-oriented type focused on selling, buying, or exchanging cryptocurrencies plus conducting different types of transactions. The central place among these platforms are taking crypto trading bots. Those programs help to use various program indicators to recognize trends and execute trades automatically when the market conditions are ideal.

To become a leader of the market you should explore the best in that field. Conduct research revising the best fintech development companies. Look through their main features and functions and decide what will be the best for you.

Source: Mobilunity

Basics for Trading Software

To understand how the system functions, we need to define clear non-functional requirements. Here are some of the main criteria that help development teams to describe the state of the product:

- high performance and multiprocessing

- reliability ( an ability to be resilient in the face of functional failures )

- interoperability ( an ability of a system to work with or use the parts or equipment of another system )

- safety and security ( how the system reacts to different types of problems and breaks and protects from unauthorized access )

- scalability ( an ability to be easily expanded or upgraded on demand )

Key Functional Features That Should Include Every Trading Platform

- Authorized profile

The authorization process should be highly reliable. For the trading app, it could be biometric protection such as Face ID or Touch ID, but for the website, users should use their credentials to log in. A two-steps authentication is also possible.

- Payment and transactions

Clients use this feature to check the flow of transactions, and the customer can run the records of transactions.

- Newsfeed

To make intelligent decisions, users should be informed of the latest news on the stock market. In that case, they will be able to perform more efficiently.

- Push notifications

Those notifications help users be up to date with various kinds of news. Also, it can notify the customer that the task is complete, etc.

- Automatic advising systems

This system helps customers make the right decisions and hands them helpful tips by reducing human factors and using machine learning algorithms.

- Onboarding

It should be very comfortable and easy to use the trading platform from the beginning. That is why it should be provided with all needed information about the usage.

- Dashboard

It will provide the client with the statistical data of his activities in a chart form.This data can then be enhanced with the Lumin PDF editor, which will make it easier for you to work with large numbers of files.

Some of those features of automated trading solutions should be supported by different payment systems, data analysis tools, risk management, and different types of charts.

Nowadays, people use their smartphones more than laptops. That’s why it’s essential to ensure that the trading platform supports any device from different parts of the world. First of all, you should ensure that your platform is competitive. Traders and brokers often manually perform the most significant part of the operations, which can be optimized and developed by a trading software development company.

Source: Mobilunity

The Advantages in Building Trading Platform Software Development

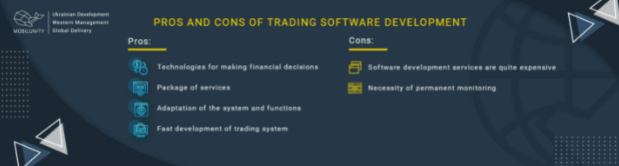

You may have some doubts if it’s necessary for you to invest money in building a trading platform. In this part of the article, we will provide you with the pros and cons of building trading platform software development so that you can decide for yourself.

Here are some advantages of automated trading systems:

- Minimizing human factor

The biggest challenge that traders usually face is hesitation. Automated systems were created to minimize this factor. They calculate every possibility of events that may happen.No emotions, just raw numbers.

- Backtesting

Imagine that you have an idea, but you’re not sure if it will work; what are you going to do? You’ll check it. Backtesting allows applying your ideas to the historical data of the market. It definitely minimizes the risks of losing money.

Or let’s imagine that the trader losses twice, and he’ll hesitate to trade the third time, but this might be the winning one. The machine won’t let you make this mistake.

- Adapting to the entry order speed

It’s evident that a computer reacts faster than an average human. Market changes quickly, so automated trading systems have to adjust at the same pace that they successfully do.

- Permit different accounts

This feature helps to use various accounts at a time and apply several strategies. This would be hard to accomplish for one person but easy to do in a short time for the computer.

Difficulties that may occur:

- Mechanical failures

Although it makes fewer mistakes than humans, the system is not perfect. We’ve already imagined that the system minimized all the risks and doubts, but what if the internet connection broke? The information might not be sent to the market, and that’s pretty risky. Also, some theories might not work in real life even if they’re checked through the historical data. It’s better, to begin with the small trading when using automated trading systems to let the system adapt.

- Should be often monitored

The automated trading system should still be checked from time to time to reduce all the technical issues: losing internet connection, power outage, etc.

- Expectations don’t meet the reality.

Sometimes your perfect plan checked and based on historical data won’t work in real life. Traders frequently think that their plan should give them almost 100% profit, although it’s not applicable in real life.

Bringing to a close, trading software development is a rapidly developing and competitive field. We’ve provided you with the basics you need to know but you should remember that to start working with an automated trading system you should be enough qualified for that.