Pump and Dump Cryptocurrency: How Does it Happen?

Table of Contents

Though digital coins and blockchain technology are relatively new, they are still prone to the same old types of scams that have been around for years. One of these scams is the pump and dump schemes.

Pump and dump schemes are illegal on regulated crypto exchanges. However, the unregulated crypto field has provided a rich ground for the schemes because users are sure they will not be easily caught by authorities.

For some in the blockchain niche, the main question is: “How do pump and dump schemes take place?” This post takes a closer look at the schemes to determine the process used to run them.

What Exactly is Pump and Dump?

Cryptocurrency pump and dump schemes represent a situation where an individual or group of persons plans to make a profit by pumping an asset into the market. The term “pumping” is used to indicate the purchasing of large quantities of coins to push the demand and price of respective coin up.

Then, they release the assets at a higher price to rake in a high return on investment. The scammers take advantage of the market dynamics of supply and demand to make investors see the price movements as a normal trend.

In many cases, scammers target new and unpopular coins that do not require a lot of money to manipulate. For example, scammers would rarely think of Bitcoin pump and dump to provoke a Bullish run because it would require a lot of money.

To rake in more from pump and dump schemes, scammers also target initial coin offerings (ICOs) because many investors are psychologically prepared to make a purchase. The ICO is preceded by intensive lobbying that target to showcase the pumped asset in good light.

How Dump and Pump Works

At the center of pump and dump schemes is a team of tech-abled, motivated, and organized players. These players operate from different points to make the publicity look genuine.

The team often includes investors who provide funding to buy the tokens and raise the demand. If the token selected is a low volume type asset, buying most of them allows scammers to control the supply and regulate the price.

As the inner team focuses on creating artificial supply, another team is working hard to demonstrate the good side of the tokens. In the past, scammers would use word of mouth to encourage people to buy dump and pump shares.

Today, scammers find it easy to motivate crypto buyers by using social media platforms such as Telegram, Facebook, and Twitter. Scammers even form groups and use influencer marketers to spread the ‘good’ word about the tokens.

Investors and traders rush to buy the tokens in fear of missing out at a high price. Once the scammers finally sell all their tokens, the hype and demand fizzles. The price suddenly crashes as investors realize it was a scam. But it is already too late!

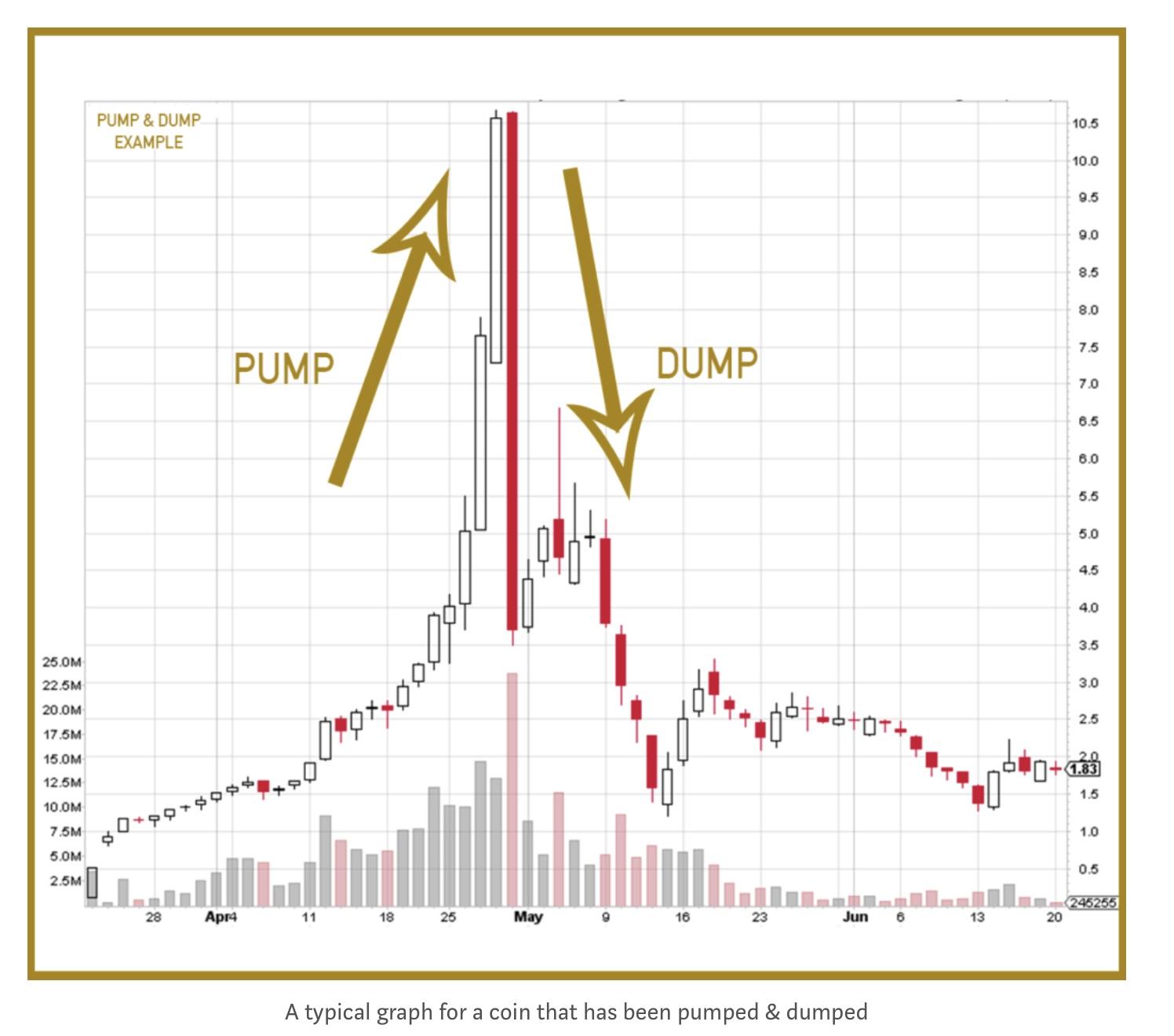

The following figure demonstrates how a typical pump and dump looks.

How to Pump and Dump Crypto in Five Steps

If you are planning to pump and dump a crypto, it is important to be adequately prepared. This includes carrying a comprehensive analysis of the targeted crypto to establish the expected results and returns. Here are the five main steps to follow for a successful pump and dump scheme.

Start by assembling a pump and dump scheme group

The process of a pumping and dump scheme commences with assembling a complete team to manipulate the market. Here, the target should be working with people who have insights about crypto markets.

You could consider partitioning the group into small units to amplify demand from different areas. One part of the team should be market analysts who can tell with precision the time to start buying or selling.

Identify investors and get the funds ready to make prompt purchases

Because a pump and dump cryptocurrency will have to involve a major purchase to create an artificial shortage, you need to mobilize ample resources to buy the tokens from the market. If you run short of funds, consider working with investors.

Run an aggressive publicity campaign to whip users’ emotions

To make more people come to the market and buy, you will need to run an aggressive market campaign. Here, it is important to be smart by using platforms that will not easily reveal your identity. For example, consider using pseudonyms on social media and running related crypto groups.

The target is creating fear of missing out (FOMO) and triggering massive demand for the coin. As more people take note of the token, start buying rapidly to demonstrate that the demand is growing. Make sure to act quickly so that others do not take advantage and buy too.

Monitor the price of the token carefully and sell once the price hits the peak

As the price approaches the peak, start selling the coins you have just bought. This is the point of maximum returns. Try to sell as many tokens as possible because the peak will not last long. In some cases, the peak only lasts for a few hours or minutes.

If you were using a crypto exchange, make sure to move your funds to your wallet immediately

It is important to note that since crypto exchanges are regulated by local laws, your funds are still not secure if discovered you run a pump and dump scheme. Therefore, move the coins promptly to a secure wallet.

Taking Advantage of Pump and Dump Cryptocurrency Schemes

Notably, it is possible to take advantage of pump and dump scheme when noted early and make profit. This will involve closely monitoring the market trend and buying as the price moves up before selling when it peaks.

Take a look at the image below demonstrating the pump and dump movements.

- Start by following the token that has been publicized so much. This could be a new coin or an already existing coin.

- Follow the price movement of the coin to notice when it starts to rise steadily. This is the pumping point and the right time to buy the tokens.

- Follow the price closely to note when it is approaching the peak and sell immediately. If you are keen enough, the price will be followed by a sudden drop. Do not wait for the price to take the downward trend because it might be too late.

What to Think About When Planning for a Pump and Dump Scheme

If executed properly, pump and dump schemes can help you to raise a lot of money within a short time. However, you need to be careful when implementing the scheme. Here are some of the things to think about:

The pump and dump crypto is illegal

Many governments such as China, the EU, and the US have warned people about pump and dump schemes. Therefore, your plan needs to be executed well to avoid getting caught by authorities.

People are learning how to identify pump and dump schemes

As the cryptocurrency niche grows, more people are learning how to detect scams. For example, people are advised to only invest a small amount of their money and stay away when the deal is too good.

Experts can easily identify your strategy and counter it by notifying buyers

Today, the crypto space is evaluated from different angles. Analytical communities such as Reddit and Bitcoin.org can easily point at pump and dump strategies and raise an alarm. Therefore, you need to implement the scheme with precision and speed.

You could pump and fail to realize the target

Today, people do not rush to buy every asset announced on the market. Even when new tokens are released, what people look for is the idea or project behind the respective token. For example, the TenX platform has been attracting a lot of interest because of the impressive project targeted to join the cryptos to fiat currencies.

It is, therefore, important to appreciate that the pump and dump scheme might not realize much. Therefore, you might consider working on the pump and dump project for longer and invest more resources to create more convincing features such as a white paper and an actual website

How to Detect a Pump and Dump Crypto Scheme

For investors, the ability to identify a pump and dump scheme could be the defining line between losing money and making good returns. But how can you identify such schemes? Here are the main strategies to use:

- Make sure to comprehensively review the targeted token before investing. This will help you note unusual trends in the market.

- Do not be emotional when investing in cryptocurrencies. Though a cryptocurrency might be hyped up so much, the truth is that there are a dozen others still out there. Therefore, do not be emotional about buying the tokens.

- Ensure to spreads your resources when investing in cryptos. This is important to avoid losing all of your money in pump and dump schemes.

- Consider targeting cryptocurrencies with reliable structures and respected personalities. For example, when you see a token backed by top personalities such as Vitalik Bitelin or Dan Larimer to mention a few, it is likely to be a good project.

The Final Take

As cryptocurrencies continue becoming popular, schemes such as pump and dump are likely to intensify because the niche is unregulated. The high profits generated from the schemes will only entice scammers to look for methods to hide from unsuspecting traders.

The above evaluation helps you to see the mind of a pump and dump scammer so that you can know how to easily identify them. Remember that you can also benefit from the mechanics by purchasing the coins of interest and selling when the price approaches the peak.

You could also consider learning more about cryptocurrency trading to understand how various indicators work and easily note abnormal trends. However, it is advisable to stay away from the market during the pump and dump period because of the high risk of losing your investment.

Easy invest with crypto but think bitcoin long journey

I fell victim to some scam forex trading platform and I lost a lot of my funds up to $160,000 but thanks to Bernie Doran for his help in getting my funds recovered. he work with a recovery company called INNOVATIONS ANALYSIS recovery. I got all my funds recovered after reporting to Mr. Bernie Doran via his Telegram – IEBINARYFX If you need help in getting your lost funds back as well, he will surely assist you

While investing in bitcoins, be cautious. If your bitcoin gets stolen, then it can be a very frustrating time but instead of getting frustrated, it is important to act fast so that you can get your money back. Unluckily, there are many victims that do not get their money back because it is very hard to track down the people behind it. The thief is either in another country or using fake identities. But in some cases, it is easy to track the person who has stolen your bitcoin. Tracing bitcoin is not hard for bitcoin forensics or specialists. You can reach out to Fightingscams (AT) aol DT com for more enquiries.

I have had my own share of binary option scam, I lost over 200k USD, and i was still told to send more money to unlock my account. I reached out to chargeitbacks and they helped me get my money back.

If you have ever been scammed or you know someone that has been scammed, chargeitbacks.com will get the money back. They are a recovery team that specialize in funds recovery, be it cryptocurrency , bitcoin, forex, catfish/romance scam.

Pump and dump scammers are just as ruthless as bitcoin investment scams. I have been a victim of bitcoin investment fraud but I managed to get my funds back all thanks to blockchargeback.com. As long as you can verify your claim, their ethical hacker help recover your funds by hacking the bad actors and they are backed by a legal team to handle any legal issue that may arise.

Once your virtual currency has been stolen it is incredibly unlikely that you will be able to recover it. In theory, it’s possible to track your stolen bitcoin by monitoring the blockchain – in practice, however, this is made difficult by both the anonymous nature of the currency and the fact that the thief will most likely use a bitcoin exchange to trade the currency for normal cash straight away. However, money does leave a trail and you may be able to follow it to the identity of the criminal. Even if you successfully use public ledgers to trace the currency, since most cryptocurrency is decentralized there aren’t many routes you can follow to get it back. Hire an expert at primedefenders dot org

Once your virtual currency has been stolen it is incredibly unlikely that you will be able to recover it. In theory, it’s possible to track your stolen bitcoin by monitoring the blockchain – in practice, however, this is made difficult by both the anonymous nature of the currency and the fact that the thief will most likely use a bitcoin exchange to trade the currency for normal cash straight away. However, money does leave a trail and you may be able to follow it to the identity of the criminal. Even if you successfully use public ledgers to trace the currency, since most cryptocurrency is decentralized there aren’t many routes you can follow to get it back. Know more at primedefenders dotorg

I was a victim of one coin scam I was left in tears , for several months I couldnt get on with life properly after losing about 75k to this scammers, I rather do charity with it or buy some exotic pets rather than just dash it out but I got lucky when I was introduced to hack101 at tutanota com they help get back all my funds from this guys .

The scammers are getting creative and using many ways. I fell into real estate scam from facebook and it was so sad that I reported to them and they did nothing about it. All these guys care about is the money they make from the ads. I eventually had to use help from Cloudsyncgeek. com before I got back almost all I lost to the scam. Almost like you are all on your own out there.

I was a victim of bitcoin scam. i was heartbroken. i fell for a romance investment on facebook because he lied he renowned the company. it really sad, i reported the scam to facebook but ]they were unable to help. But in my search for help i got lucky when i was introduced to GRANTBEYOND dot net, they helped me get back all my funds from this scammer

What is next after losing 2.5 BTC to scammers?

Well, you have two options, one is to accept the loss and let the scammers have your hard earned money.

This act will make the scammers thrive, because you didn’t stop them, more people will fall victim, these victims will probably be your friend or your relative.

On the other hand you can file a report with bitcoin recovery experts such has Freddictine At consultant dot com, they will help you trace and recover your bitcoin, works with law enforcement agencies to help bring these scammers to book.

As long as you have the scammers wallet address, you are good to go.

I wish you best of luck in your bitcoin recovery.

The biggest issue with cryptocurrency is that it is unregulated, which is why different people can come up with different fake stories all the time, and it is unfortunate that platforms like Facebook and others only care about the money they make from them through ads. I saw an ad on Facebook for braveclimbingfx and fell into the scam, losing over $30,000. I reported it to Facebook, but they did nothing until I discovered deftrecoup . c o m from a crypto community; they retrieved approximately 95% of the total amount I lost.