Robinhood IPO and Bitcoin: A Path to Recovery

Table of Contents

It’s been a chaotic year for bitcoin. The world’s most famous cryptocurrency reached new all-time highs at the start of 2021. This sparked a wave of investor optimism. However, it then suffered a sharp collapse, wiping out much of its gains from the past six months. Now, as the market grapples with its next steps, could Robinhood IPO and Bitcoin help drive a recovery?

Although volatility in crypto is nothing new, bitcoin’s recent crash has sent much of the market into a downward spiral. This dip is unfamiliar to many new investors who joined since the start of the Covid-19 pandemic.

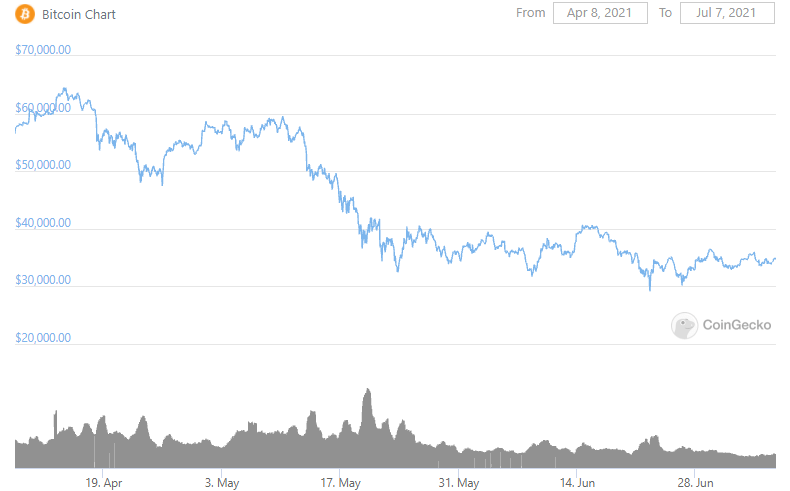

(Image: Coingecko)

Bitcoin dropped more than 50% from its April peak of $64,800. The initial downturn saw high trading volumes. However, activity has slowed in recent weeks, with the market hovering around $35,000. This uncertainty highlights how Robinhood’s IPO and Bitcoin could drive a recovery, offering new ways for retail investors to engage with cryptocurrencies.

The reason behind this dip isn’t exactly clear. Elon Musk sparked widespread concern at the carbon footprint of bitcoin mining by announcing that Tesla would no longer be accepting the cryptocurrency as payment for their range of cars, while continually tightening regulations surrounding cryptocurrencies in China have also caused fear across the market.

The outlook for bitcoin remains uncertain in the near term. However, Robinhood’s long-awaited IPO could contribute to a cryptocurrency recovery. It may drive asset prices higher, similar to the expectations surrounding Coinbase’s IPO in April.

Succeeding Where Coinbase Failed

Linking Coinbase’s IPO to failure is harsh. There’s still optimism that the exchange’s market value will recover as the market picks up. However, some commentators expected the listing to boost bitcoin’s value. In reality, the IPO did little to stop the decline of BTC during May and June.

As Coinbase’s price chart shows, the market value of the exchange has largely traced Bitcoin since the time of its April listing.

However, Robinhood’s listing offers something different to investors. Rather than Coinbase, Robinhood offers a more hybrid approach to investing, with the platform listing cryptocurrency, stocks and even IPOs following the launch of the platform’s IPO Access portal.

(Image: Bloomberg)

Robinhood’s Popularity Among Retail Investors

As the table above shows, Robinhood has won favour with a huge volume of retail investors since the beginning of the Covid-19 pandemic. During the controversial recent GameStop short squeeze of early 2021 – much of which was conducted through Robinhood accounts – downloads of the app soared by over 800%.

Maxim Manturov, head of investment research at Freedom Finance Europe says that “One of Robinhood’s major issues is the lack of liquidity against the large demand on GameStop (GME) stock. The liquidity issue is however not uniquely Robinhood’s problem, as many other brokers also experienced it when offering GME.

Robinhood had to set limits, causing traders to rush to other platforms like Square and SoFi. Many investors were unhappy with these limits. As a result, they filed complaints and claims against Robinhood. However, the company denies involvement with third parties, stating that no external influence affected the decision to impose limits. These restrictions were likely a technical necessity to provide liquidity. Robinhood needed time to raise cash to cover transaction costs and pay investors who wanted to cash out.

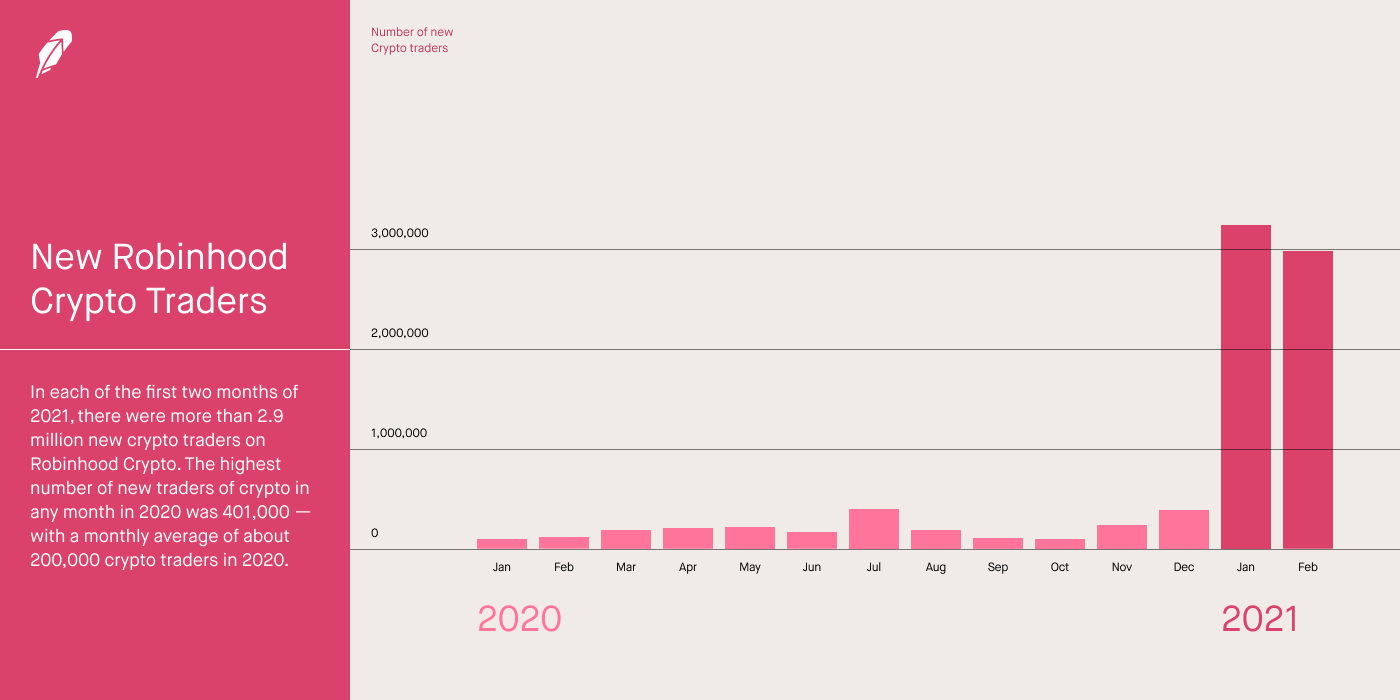

(Image: Robinhood)

Robinhood’s Role in Crypto Adoption

As well as a huge number of stocks, Robinhood currently offers seven major cryptocurrencies for investors to trade. This window into crypto has introduced many casual investors to digital currencies. It has enabled them to buy and sell BTC without needing a dedicated crypto exchange.

At the start of 2021, Robinhood averaged over 3 million new cryptocurrency traders a month. This was a significant increase from 200,000 in 2020.

This makes the prospect of a Robinhood IPO and Bitcoin much more tantalizing than that of Coinbase when it comes to sending cryptocurrencies towards more mainstream acceptance. In going public, Robinhood can gain the validation and growth it needs to be the perfect gateway to crypto for retail investors, paving the way for much more widespread adoption.

One of 2021’s Hottest IPOs

Robinhood rarely strays from the headlines, and in 2021 the app has been embroiled in a number of controversies surrounding investor freedom, the gambling aspect of its business model and the rise of short squeezes across the stock market, but this hasn’t stopped Robinhood from launching one of the world’s most sought after IPOs.

Many online brokerages have been scrambling to list Robinhood’s initial public offering, including Freedom Finance Europe, a Nasdaq-listed company that’s gone to the effort of creating a dedicated portal especially for investors to access and buy into the IPO – albeit after a registration process and a financial threshold of at least $2,000 is met.

Other traditional brokerages, like Fidelity and TD Ameritrade, are adjusting to accommodate the Robinhood IPO and Bitcoin. However, they have much higher financial threshold requirements. In some cases, investors must have over $500,000 in household assets to access the initial public offering.

Robinhood’s IPO could be one of the most significant of 2021. Its impact on the broader investment world may be far-reaching.It may also give them the confidence to embrace assets like bitcoin. With many factors influencing the market, a strong Robinhood listing could help drive a short-term BTC recovery.