How to Turn Bitcoin into USD

How to turn Bitcoin into USD is an uphill task that often requires the use of multiple platforms. Because Bitcoin is not recognized as a legal tender in most countries, and the definition of digital currencies is also unclear, many entities handling them opt to stay away from acting as a bridge with fiat currencies.

To help people who have Bitcoins or that want to join cryptocurrencies but harbor fears about conversions, this post digs into the best method to turn Bitcoin into USD.

Cashing Out Bitcoins Online

This method involves using a platform that allows the Bitcoin owner to interact directly with the buyer using an intermediary site. The intermediary platform charges a fee for facilitating the transactions.

The process requires the Bitcoin owner – you – to select a financial service provider (preferably a bank) to create a seller’s account and complete it with ID verification. Then, you are required to post the Bitcoins to be sold so that the facilitating selling platform can identify a buyer and initiate the transaction.

To keep your coins safe, the Bitcoins may be frozen once they are deposited into the platform’s account. Once the potential buyer is identified, he is required to send the ordered amount in fiat for the Bitcoins on sale before they are deposited into his wallet.

The process ends with the amount your Bitcoin fetched being deposited into your bank account and the digital coins being transferred to the buyer. Note that the amount you will receive is less the transaction fee for the facilitating platform.

One of the companies that use this method is Coinbase exchange. Coinbase has indeed simplified the process so much that you can turn Bitcoin to USD with just a few clicks. They even allow Bitcoin owners to cash them out promptly using mobile phones.

The transaction fee at Coinbase varies depending on the amount under consideration. For example, the Coinbase website indicates that if you state that $100 as the amount of Bitcoin to sell, the fee is 1.49%.

This video is a demonstration of how to turn Bitcoin into USD:

Cash Out Your Bitcoins Offline

If you feel that the transaction fee charged by most exchanges is too high, one of the alternatives of how to turn Bitcoin into cash is selling directly to clients. One of these methods is using financial services that allow the seller and buyer to interact on a peer2peer basis.

The services are designed to help automate the detect geolocation and outline actual offers in your area. One of the services using this model is LocalBitcoins.

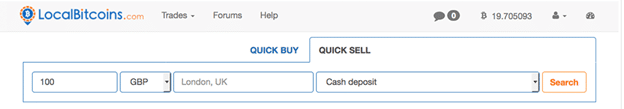

LocalBitcoins.com is probably the simplest answer to the question “How do you turn Bitcoin into cash?” The method requires the Bitcoin holder to register for an account with LocalBitcoins.com website to receive a secure offline Bitcoin wallet.The second step is sending the Bitcoin you intend to sell to the wallet you have just created. Then, you select the amount you want to sell Bitcoin for and select the preferred method of payment. To complete the process faster, you can even opt for the QUICK SELL option. See the caption below of the interface snippet from LocalBitcoins.com.

For a step-by-step guide in video format on how to sell Bitcoins for cash, follow the link below:

It is also possible to find buyers on cryptocurrency forums such as Reddit and BitcoinTalk and agree on the terms of payments. However, such methods are highly risky and should only be used with great caution because they lack advanced operational guarantees such as those available on other platforms such as Kraken.

Use Trading Platforms to Turn BTC into Cash

Rather than trading directly with another person, some people opt to convert Bitcoins into cash by using trading platforms that combine crypto and forex trading exchanges. These platforms require users to start by registering accounts and verifying them using government-recognized info such as a phone number and date of birth.

Then, the Bitcoin holder has to deposit the coins on the exchange account, place a sell order stating the preferred currency of payment and price. When a matching buy order is placed, the transaction is completed.

Notably, these exchanges are centralized and are considered an easy target for attackers. If you pick any big loss in the crypto industry, the chances are that it happened in the exchanges. One of the latest attacks on the crypto exchanges happened at YouBit in December 2017 and resulted in the platform filing for bankruptcy.

One of the top exchanges that allow users to cash their Bitcoins for cash is Kraken. This is one of the leading exchanges, which was started in 2011, that has won the tag of the gateway to the cryptocurrency industry for supporting crypto to fiat transactions and vice versa.

To use Kraken, digital coin holders are required to start by registering accounts and confirming them with additional information like proof of location, phone number, and date of birth.

After creating a Kraken account, you are required to deposit the Bitcoins to be converted to cash. The platform requires the account holder to place an order based on the amount he wants to sell the Bitcoin. You will also be required to provide the bank account for the fiat deposit after the transaction is completed.

It will take between one to five days for the transaction to be completed and the funds to be deposited into your account. Note that if you want to sell Bitcoin for USD and withdraw to a local US bank, a fee of $5.00 is levied.

For a video on how to turn Bitcoin into USD using Kraken, please follow the link below.

Turn Bitcoin into Cash Using Currency Converters

Though less profound compared to the cryptocurrency exchanges, the currency converters provide an instant method of converting currencies, including digital coins, from one form to another. These services require users to join the platform and specify the amount to convert and at how much.

One of the prominent cryptocurrency converters in the market today is WealthPay. This currency converter uses an automated model to collect the latest exchange information so that users are assured of converting BTC to cash using the top rates.

The converter is also highly flexible and can deposit your Bitcoin funds either to your bank account or credit card. Besides, they also indicate that transactions are cleared with 24 hours. In some cases, the transactions can be completed in less than one hour.

The biggest challenge of using the converters is the fast-rising number of companies offering the same services. This makes it very difficult to differentiate between genuine converters and scammers.

Though people who want to convert Bitcoin for cash are advised to used sites such as BestChange.com and OkChanger to narrow down to reliable converters, it still looks like trusting converters is difficult. For example, some of the converters listed on the platforms have resulted in complaints from communities such as BitcoinTalk.

Use a Direct Electronic Payment System

To make it easier to convert digital coins to fiat and vice-versa, advanced multi-functional electronic payment systems have started entering the market. These systems allow users to open Bitcoin accounts and make transfers effortlessly to their credit cards or bank accounts.

The multi-functional electronic payment systems are considered to be among the next most important developments that the blockchain needs for faster adoption. As more countries, such as Singapore and Switzerland, continue appreciating the importance of digital currencies, the integrated electronic payment systems are likely to become more important and even get adopted in the retail markets.

One of the top examples of the multi-functional electronic payment system is Worldcore.eu. The service requires users to open accounts and fund them using either fiat or digital currencies. The system is connected to BitPay to allow it to accept and process Bitcoin. If you fund the account with Bitcoin, converting into USD is simple, fast, and direct.

Like other conversion services, Worldcore.eu charges a fee of 3-7% when transferring digital assets. Even with the associated convenience, the community has complained that the fee is punitive and might limit the service adoption, especially by people transacting only a few coins.

For those using debit cards and ATM withdrawals, Worldcore.eu caps the daily limit at 4,000 Euros.

The Final Take

Though the issue of how to turn Bitcoin into USD or other currencies has persisted for long enough, some light at the end of the tunnel is now evident. More players are joining the industry to help make the process of converting crypto coins to fiat or vice versa prompt, direct, and reliable.

ew methods such as advanced multi-functional electronic payment system and cryptocurrency converters have demonstrated that it is possible to finally integrate the digital coins into the standard payments. Despite this, it is important to appreciate that the element of risk still looms.

All the outlined methods are centralized. This implies that the Bitcoins you want to turn into cash are still prone to attacks. Therefore, you should take every precaution by ensuring that only the amount to be converted to cash is transferred to the converting platforms while others remain locked in cold storage by using wallets such as the Ledger Nano S.

Bitcoin has said they converted BTC into USD currency and I need an application to withdraw can you give me information on this is this right or wrong