Crypto Adoption In Banking Transforms Financial Services

Table of Contents

Cryptocurrency has become a popular investment option. It offers a secure way to make transactions. As this Fintech technology is adopted by more businesses, it could become the standard for payments in the next 10 years. Crypto adoption in banking is also gaining momentum. Major institutions are exploring blockchain and digital currencies to improve financial services. In this article, we’ll explore the future of crypto and the changes expected in 2020 and beyond.

Proof Of Stake Vs Proof- Of- Work

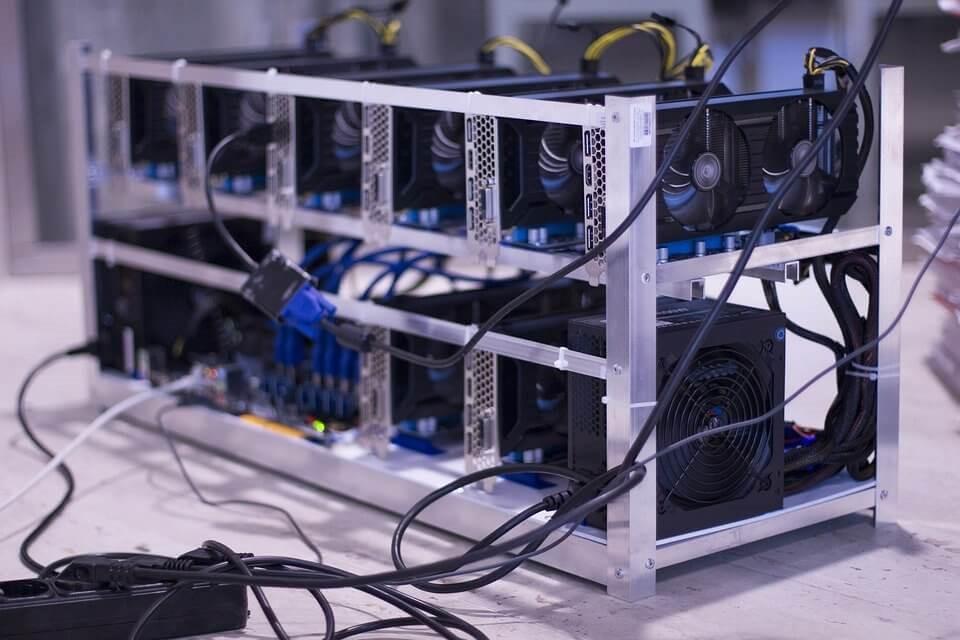

When Bitcoin was originally created there was a system put in place that was set with the aim to verify each transaction without the need for a third-party application. This was the use of the Proof- Of- Work system. This network made sure that each investment was valid and that funds where not being spent twice. However, this has since changed.With a vast amount of electricity needed to run the network and a limited number of transactions being processed at once. This has since lead to many cryptocurrencies using a Point-Of-Stake system. This works slightly differently than the POW system as the mining power is given to the miner that holds the most coins. This way, the POS miner only processes a share of transactions equal to their ownership stake. For example, someone who owns 5% of Bitcoin can only mine 5% of the blocks.

This approach reduces the risk of hacks and strengthens network security. Ethereum is one of the most recent cryptocurrencies to adopt this method, creating a more modern and reliable system. Crypto adoption in banking is also benefitting from these secure and efficient mechanisms. Financial institutions are exploring reliable blockchain models to handle sensitive transactions.

Crypto Use Within The Gambling Industry

In addition to alternative software, cryptocurrencies have other practical uses—especially in online gambling. Many people use crypto to buy and trade assets. Others are now gambling online using Bitcoin. Crypto poker is becoming a popular form of gaming. It reaches wider audiences and allows for secure deposits during games. Each transaction is processed quickly, so players can collect winnings within minutes. Though still in its early stages, this trend is expected to grow in 2020 as more users chase online jackpots.

Blockchain Becomes Widely Accepted By Banks

Though many that are in traditional banks are hesitant to move into the world of digital currency, there are some that are beginning to acknowledge their popularity. With IBM, Citi, CLS and Barclays forming a partnership to launch a blockchain app store for banks, this has kickstarted the future of Cryptocurrency becoming widely accepted as a currency. In addition to this, there are also a number of start-ups that are taking advantage of digital currencies as an alternative too traditional banking. This is in part down to security as well as the internet making this form of currency more accessible.

Furthering The Ability To Pay For Items

In addition to this, the popularity of Blockchain is increasing, this, therefore, means that a number of institutions are now allowing for payment to be made through Bitcoin and other online currencies allowing them to be used for much more than just cryptocurrency trading as they are at the moment. This change is set to open up cryptocurrency to a wider audience and help to maintain a sense of online security. One of the biggest international companies that is now accepting cryptocurrency is Microsoft. This allows users on both PC and Xbox platforms to purchase from the game store with this currency. Additionally, there is also the option to purchase items on Etsy. However, there are a number of retailers on Etsy that will not accept bitcoin, therefore it is important to check this beforehand to ensure you are able to spend your Bitcoin on the platform.

As of July 2017, other companies such as Lush now accept Cryptocurrency. Though this is only online, the increased use of currencies such as this will soon begin to expand into a number of other businesses and stores.

This benefits users of digital currencies, as they will soon be able to shop both online and in-store with cryptocurrency. It’s also a major advantage for the Fintech industry. A large portion of the market is not using traditional banking methods. By accepting digital currencies, online stores can reach wider audiences. This is especially helpful for small businesses. They can drive more sales and maintain a healthy customer acquisition rate.

Blockchain technology adds further value. It stores and processes each transaction efficiently. This boosts business growth and offers multiple secure payment options.

Whether you’re running a business using Bitcoin or investing in the future of crypto, the industry is evolving rapidly. Crypto adoption in banking is one such trend, as more financial institutions integrate digital assets into their systems. Will you be investing?

Nice share First Option Recovery, as a fund recovery group, has been in the business for over a decade now and with its unique approach and professional methodology of recovering funds, you can place your cent percent trust in us about getting your money back from chargeback scam.

Thanks for posting

Nice Info

Insightful article, definitely looking forward to crypto becoming more widely accepted by banks! That might stabilise them some more, to lower the barriers to entry of buying in. Fintech is truly becoming the next big thing! Thanks for the solid foresight here!