Investment Strategies Maximize Returns with Key Analysis

Table of Contents

In the dynamic world of asset trading, two predominant schools of thought are fundamental and technical analysis. These methodologies guide investors and traders in maximizing returns. Investment strategies maximize returns by combining the strengths of different approaches. In our experience, integrating insights from both schools is crucial. We’ll share insights from our collective experience, backed by real-world examples, to clarify these concepts and advocate for a hybrid approach that utilizes the strengths of both methods.

Fundamental Analysis: The Long-Term Investor’s Compass

Benjamin Graham, the father of value investing and author of “The Intelligent Investor,” encapsulated the essence of fundamental analysis in his advice: ‘Invest only if you would be comfortable owning a stock even if you had no way of knowing its daily share price.’ Investment strategies maximize returns by focusing on informed decision-making and long-term value. This philosophy is the cornerstone of fundamental analysis, focusing on understanding the intrinsic value of an asset, the ‘what’ and ‘why’ behind an investment.

Other investing gurus like Peter Lynch and Charlie Munger have successfully employed this strategy to consistently outperform the market. It involves a deep dive into a company’s financials, its environment, and industry dynamics to determine whether it’s undervalued or overvalued. This process includes assessing factors such as GDP growth, industry competitiveness, and company-specific elements like management style and business model. Peter Lynch’s observation rings true in our approach: “A share of stock is part ownership of a business.”

Key Concepts of Fundamental Analysis

Intrinsic Value: The Core of Fundamental Analysis

Intrinsic value lies at the heart of fundamental analysis. It represents the “real” value of a stock, based on fundamentals such as earnings, dividends, and growth rate, rather than its current market sentiment price. Consider the case of GameStop, whose share price experienced dramatic fluctuations within a short period, driven more by market sentiment than changes in the company’s actual fundamentals. Our goal in fundamental analysis is to identify this intrinsic value, looking beyond short-term market fluctuations. As investor Bill Ackman puts it, investing should be a rational process, free from emotional influence, focused purely on the facts.

Value vs. Growth Investing: Two Sides of the Same Coin

Fundamental analysis branches into two main strategies: value and growth investing.

- Value Investors look for stocks they believe are undervalued — selling for less than their intrinsic value. They typically favor stocks with low Price-to-Earnings (P/E) ratios. For example, they might be drawn to an established manufacturing company facing temporary issues, believing that its stock price will eventually realign with its intrinsic value.

- Growth Investors seek companies exhibiting signs of above-average growth. They may opt for stocks with high P/E ratios, focusing on potential rather than current earnings. A typical choice might be a tech startup with rapidly increasing revenues or network effects.

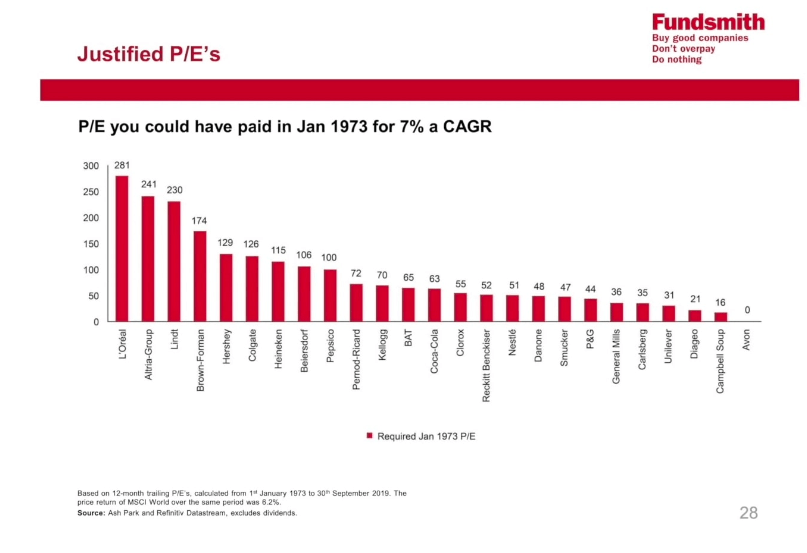

Despite differences, both strategies have historically found success. High P/E ratios can still yield excellent returns, as evidenced by companies that have delivered Compound Annual Growth Rates (CAGR) of over 7% as seen in the graph below.

Margin of Safety: A Prudent Investor’s Buffer

The concept of the “Margin of Safety,” as explained by investor Seth Klarman, is vital. It suggests buying with an additional cushion to account for uncertainties and biases. Since intrinsic value is an approximation, subject to our interpretations and potential overconfidence, this margin provides a safety net against unforeseen variables and errors in judgment.

Technical Analysis: Timing the Market with Precision

Contrastingly, technical analysis concentrates on the ‘when’ of investing. It interprets historical market data to forecast future price movements. Investment strategies maximize returns by leveraging precise timing and data-driven insights. Charles Dow, often regarded as the grandfather of this methodology, emphasized the importance of discerning market signals. Technical analysts use tools like charts, indicators (such as Moving Average and Relative Strength Index), and patterns (like the ascending triangle or head and shoulders) to predict market movements.

For example, understanding the formations of candlestick patterns in a stock can guide decisions on optimal buying or selling times. This method is particularly beneficial for short-term traders who exploit market psychology and trends.

Key Concepts of Technical Analysis

Price and Volume Analysis

This involves examining historical price movements and trading volumes. Key elements include:

- Resistance and Support Levels: Points where prices historically stop and reverse.

- Moving Averages: Tools like SMA and EMA help identify trends.

- Candlestick Charts: Display opening, closing, high, and low prices for a specific period.

Trend Analysis

Focuses on identifying the direction and strength of market trends using:

- Trend Lines: Connect highs and lows to visualize trends.

- Price Channels: Parallel lines indicating potential buy and sell points.

Market Cycles

Understanding the cyclical nature of markets is key. It includes phases like accumulation, markup, distribution, and trough. These phases help align investment strategies with market dynamics.

Support and Resistance Levels

Identifying these levels assists in spotting potential trading opportunities, with support indicating a likely halt in a price drop and resistance suggesting a pause in price rise.

Each of these concepts plays a critical role in technical analysis, offering insights into market behavior and aiding in decision-making for trading strategies.

Conclusion: Maximizing Investment Potential with a Hybrid Approach

Our comprehensive journey through the realms of fundamental and technical analysis culminates in a powerful, combined strategy that we believe optimizes investment potential. Let’s consider a practical example to illustrate this hybrid approach in action.

Imagine we’re analyzing a particular stock. Through fundamental analysis, we assess its financial health, market position, and growth prospects, concluding that it’s undervalued — a potential hidden gem. This gives us a strong investment thesis and a deep understanding of the asset’s intrinsic value.

Next, we turn to technical analysis to refine our strategy. We examine price trends, support and resistance levels, and other technical indicators to determine the optimal time to enter the market. Perhaps the stock is approaching a significant support level, suggesting a likely rebound in price. We decide this is our cue to buy.

In essence, the synergy of fundamental and technical analysis allows us to ground our decisions in a thorough understanding of an asset’s value, while also capitalizing on market timing to maximize returns. This balanced, dual-methodology approach empowers us to navigate the complexities of the investment landscape with greater confidence and efficacy.