Crypto Collateral Loan Platform for Fast and Secure Cash Access

Table of Contents

Instead of mortgaging a house or taking out a loan to purchase a vehicle, it is now possible to use digital coins to secure a loan on the Secured Automated Lending Technology (SALT) platform. This crypto collateral loan platform allows people to use cryptocurrencies as collateral for cash loans.

SALT prides itself on being the pioneer in the asset-backed lending niche and allowing users to access loans faster. After entering the market, it recorded remarkable success as demand for its services increased and the price of its native coin grew by about 150% to $17.68 by December 29, 2017.

Even with this remarkable showing, the platform went silent in May 2018 after suspending further registration and purchase of SALT tokens when the demand for loans surpassed $1.3 billion.

Although SALT CEO Bill Sinclair came out in September 2018 to indicate that the platform was back, key questions about the viability of the system still linger. This SALT crypto review evaluates how the platform works and answers the burning question: “Should you invest in SALT coins?”

A Closer Look at the SALT Token

SALT platform was founded by Blake Cohen in the third quarter of 2017. Blake is a former real estate expert who used SALT to gain entry into crypto entrepreneurship. The launch of the lending platform also saw the platform release its native token, referred to as SALT.

The tokens were released during the August 2017 SALT ICO when 45% of the total 120,000,000 SALT tokens were sold at a price of $0.89 each, raising $48 million for the crypto collateral loan platform.

SALT is an ERC-20 coin, which means that it is based on the Ethereum blockchain. The coin is the main method of payment on the SALT platform. However, you can still use it for other purposes such as trading in the exchanges and sending value on a peer-to-peer basis.

A closer look at the performance in the market shows the coin in a decline. When SALT entered the market on September 29, 2017, the price of the coin was $6.91. Although the value grew to reach $17.68 on December 29, 2017, the highest mark in its history, it declined, reaching a low of $0.67 in early November 2018.

How Does SALT Lending Work?

SALT platform operations mainly revolve around its trademark blockchain-backed lending. This type of lending involves handing over blockchain assets such as Bitcoin or Ethereum to serve as collateral for a loan.

This means that you get access to cash for personal/ business use without having to sell the assets. SALT only holds the asset and does not claim the value it gains during the loan repayment period. The platform operates through the following structure.

SALT Membership

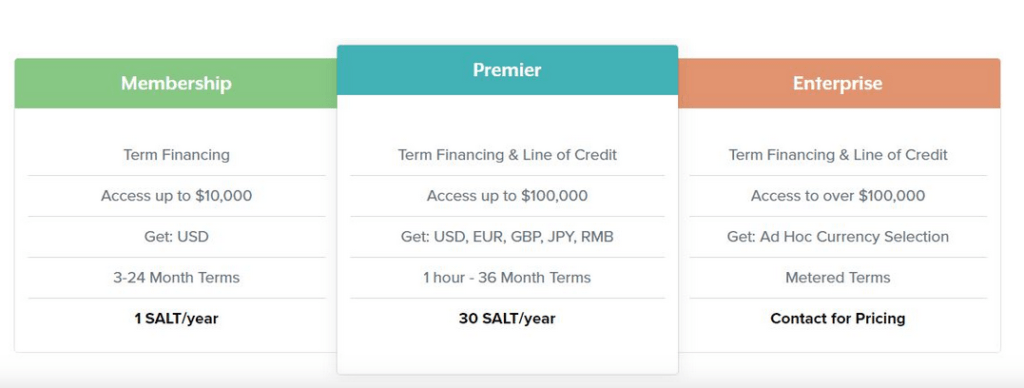

To start using the SALT platform, users are required to begin by becoming members. This membership is broken up into three categories based on the amount that a user can borrow and the currencies that can be used as collateral.

- Base

- Premier

- Enterprise

The higher the membership tier, the more cash the user can borrow from the crypto collateral loan platform. Higher tiers also enjoy perks such as credit card support, portfolio management, and early access to new products. The image below demonstrates the different membership tiers.

To join and borrow money from SALT, you only need to provide a first name, last name, and email address.

To get access to loans, SALT also subjects its members to know your customer (KYC) and anti-money laundering (AML) requirements because it is registered under local laws in Denver, CO. Therefore, be prepared to provide a copy of your ID and other identification that might be required.

The Lenders

As borrowers place their orders on one side of the SALT platform, the lenders are playing another role on the other end. The SALT system works with various lenders who provide cash to borrowers for a profit. SALT provides willing lenders with the infrastructure and compliance needed to accept cryptos as collateral.

Like the borrowers, lenders also are required to also join the platform as members.

The SALT Oracle

This is perhaps the most important component in the SALT loan application process. The SALT oracle generates a smart contract for every loan on the platform to ensure that both borrowers and lenders play by the rules.

The Oracle also follows the loan repayment and value of the cryptocurrency deposited as collateral.

All loans offered by SALT are calculated on the basis of the loan-to-value ratio derived from the terms created by the Oracle smart contract. For example, a $200,000 loan application secured by $250,000 worth of Bitcoin would have a ratio of: $200,000/$250000 = 80%.

SALT loans are 60% the value of the collateral.

As the borrower pays off the loan, the ratio goes down because the outstanding amount also shifts downwards. The ratio also can go up if the value of the collateral falls in the market.

If the value of the collateral falls so much that it pushes the ratio above the original loan-to-value ratio, the borrower is expected to provide additional collateral. When the loan is cleared fully, the collateral is released back to the borrower.

Is SALT Secure?

The structure of SALT is seen by crypto enthusiasts as an idea whose time has come. It is a milestone that people can use cryptocurrencies as collateral for securing cash. However, is the entire SALT platform secure?

SALT’s founders and developers wanted to provide borrowers, lenders, and SALT cryptocurrency holders with a reliable and secure platform. Here are some of the strategies used to keep SALT secure:

- The SALT coin is based on the Ethereum blockchain that acts as an additional layer of security.

- SALT Lending Holdings is registered as a financial services provider. This means that it follows US federal laws including insuring the cash being lent to borrowers. It also adheres to federal anti-money laundering (AML) and know your customer (KYC) rules.

- The development team constantly reviews the platform and releases updates to seal gaps and address vulnerabilities.

These efforts helped SALT to operate without a record of a successful hacker attack until early November 2018. Despite this, the community still feels unsure about the platform’s future following the long silence between May and September 2018.

The management of the platform has to work hard to win the trust that people had in it immediately after its launch. Users need to be sure that they will not wake up one day and find that management has run away with their funds.

A Summary Of SALT’s Pros And Cons

The design of the SALT platform and SALT cryptocurrency has opened up a new line of credit for personal or business operations. Here are some of the pros and cons associated with SALT.

Pros

- Allows members to get loans faster using their crypto coins such as Bitcoin and Litecoin as collateral

- The loan process is fast and efficient

- It is a legal method of accessing loans because SALT is a registered financial services provider

- SALT has an easy-to-use platform

- SALT customer support is very responsive

- Loans at SALT are offered at low interest rates of about 5.99%

Cons

- The performance of the native coin, SALT, has been dismal, especially in 2018

- The community has lost trust in SALT leadership after it went silent for months from May to September 2018

- The platform demonstrated that it cannot handle many orders after it indicated that $1.3 billion in loan requests were overwhelming

- Users are required to keep topping their collateral if the price takes a downward trend

The Final Take

When SALT announced that crypto enthusiasts would be able to access loans easily, the community believed that a convergence point for crypto and fiats had finally been found. This was the reason why many people joined the platform with enthusiasm.

Although the rising orders were indeed overwhelming, SALT had already tested its idea and demonstrated it could work. As the crypto niche keeps growing, blockchain-based lending through a crypto collateral loan platform is expected to become more important. Why sell your coins when you can use them as collateral?

The statement by Bill Sinclair that SALT now can lend to more people in the US should be considered an important indicator of good things to come. Therefore, if you are planning to invest in cryptos, this could be a great opportunity to buy SALT crypto and expect to reap the rewards as demand grows.

However, it is also important to be smart. Like other cryptocurrencies, growth is only based on speculation. Therefore, spread your risk amongst different cryptos and be sure to only use what you can afford to lose.