Future of Bitcoin Prices: Trends and Predictions for 2023

Table of Contents

People who invest in Bitcoin are hoping that the U.S Federal Reserve will stop raising interest rates soon. The April inflation data shows that prices are not going up as much as before for 10 months in a row. This gives people hope that bitcoin will soon go up again and will be worth more money, but you might as well invest in real casino online games and get a quick return on your money without long waits.

The U.S banking system is not doing well right now. This means that people are looking for different ways to invest their money instead of using regular methods.

Factors Influencing the Price of Bitcoin

Recently, Bitcoin went down in value. Binance is a place to trade cryptocurrency. They stopped people from taking out their Bitcoin more than once each day because too many people were trading and things were not working properly. Prior to this event, Bitcoin had been trading at around $29,000 and was seeking to reach $30,000 once again.

Data from CoinMarketCap shows that stable coins make up almost all of the total crypto market’s 24-hour volume. This is $22.22 billion out of a total of $25 billion. Bitcoin’s dominance is currently at 46.40%, which has risen by 0.08% in the day.

A month ago, Bitcoin cost less than $20,000. But now it is worth more because of something that happened with a bank in the U.S. People are interested in using cryptocurrencies instead of normal banks when there is a financial crisis.

Analyzing the Potential for a Crypto Comeback in 2023

Nobody knows what will happen with Bitcoin in the future, so it is important for people who own Bitcoin to keep an eye on it. This year has been particularly volatile, with Bitcoin still trading nearly 50% below its previous peak. This volatility can be attributed to the macroeconomic conditions in major global markets like the US and UK.

The government in India has strict rules about cryptocurrencies

All cryptocurrency transactions must follow the Money Laundering Act. This means that the Prevention of Money Laundering Act will be applied to any digital transactions like virtual currencies or digital assets.

The new development in India about crypto might seem bad at first, but people who work in the crypto industry are happy about it. This is because it is a step towards regulating the space. Without regulators, enforcement agencies will have to directly address any issues that arise.

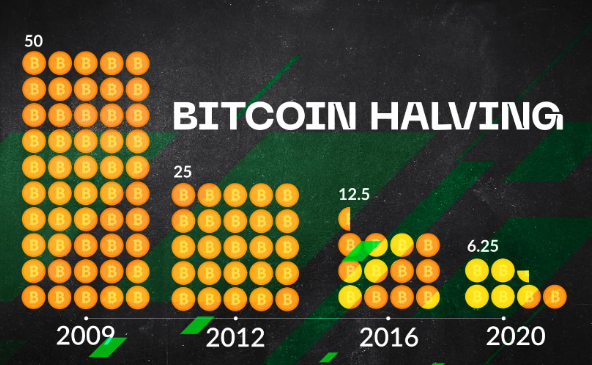

Experts believe that Bitcoin’s price will increase because of the halving event that will take place in 2024. Every four years, Bitcoin has a special event. During this event, the amount of money miners get for mining Bitcoin is cut in half. After the event, miners will get 3.125 BTC each time they mine Bitcoin. This is expected to positively impact Bitcoin’s price, as it reduces the supply of Bitcoin. Historically, the halving event has been associated with a significant increase in Bitcoin’s price, shaping the future of Bitcoin prices in a bullish direction.

Here is the history of the Bitcoin halving and its impact on prices:

- In 2012, the Bitcoin halving event occurred and the price on that day was $12.35. 150 days later, the price had risen to $127.

- In 2016, another halving took place and Bitcoin was valued at $650.53 on that day. 150 days later, the price had risen to $758.81.

- The most recent halving occurred in 2020, with Bitcoin valued at $8821.42 on the halving day. After 150 days, the price had risen to $10,943.

Upon analyzing the data, it becomes evident that past Bitcoin halving events have served as long-term drivers for Bitcoin’s bullish price trend. This is due to the deflationary aspect of Bitcoin, which is directly related to its halving event. The halving constricts the supply of BTC, which prompts a rise in its price. Since Bitcoin is a decentralized cryptocurrency that no government or central bank can print, its supply remains finite.

Examining Strategies to Make Money with Bitcoins In 2023 and Beyond

It appears that “Bitcoin Whales,” or large investors, are buying more BTC. Reports show that these investors, who hold between 1,000-10,000 BTC in their wallets, have been accumulating more. This suggests that the price of Bitcoin may be recovering, which could have a significant impact on the future of Bitcoin prices.

Is it possible for Bitcoin to hit $100,000 by 2023? This year, the cryptocurrency has gone up almost double in value. It is worth more than lots of other things and has given good money back to people who bought when it was cheaper. Marshall Beard from Gemini is very excited about Bitcoin. He believes that it could go higher than $69,000 this year and reach $100,000. That means it will need to go up by 270% to get to the one hundred thousand dollar level.

Advocates of Bitcoin believe that 2023 could be a great year for the cryptocurrency since it’s viewed as a trustworthy investment that provides protection or profitable returns amidst chaos. This surge is due to predictions that the U.S. Federal Reserve will refrain from increasing interest rates aggressively, providing a significant boost to Bitcoin.

Will Bitcoin’s value reach $1,000,000 by 2025?

Some Bitcoin enthusiasts have made very optimistic and potentially unrealistic predictions about the future value of Bitcoin. There are now talks about Bitcoin hitting a price of $1 million by 2025 after recent price increases. Many notable figures in the cryptocurrency industry have shared this hypothetical prediction.

Assessing the Impact of Cryptocurrencies on Global Markets In 2023

According to Marshall Beard, the chief strategy officer at U.S. cryptocurrency exchange Gemini, although there are some unusual circumstances happening in the world, he believes it’s unlikely that Bitcoin will reach $1 million in value within the next 90 days. He predicts that it may take up to 10 years to approach this level of valuation.

Could Bitcoin Crash in 2023?

Some investors, corporations, and institutions have a bearish view on Bitcoin. They believe that the recent rally is a “bull trap” rather than a “bull run.” Global investor Mark Mobius even predicts a significant drop in 2022, possibly bringing Bitcoin down to the $10,000 range.

Matthew Sigel, head of digital assets research at global investment manager VanEck, predicts that Bitcoin will drop to $12,000 levels due to higher energy prices. Another surprising prediction comes from global bank Standard Chartered, which forecasts that Bitcoin could fall to $5,000 levels by 2023.

These conditions create uncertainty in the market, causing investors to prefer avoiding risky assets like Bitcoin. Additionally, BTC holders may sell their positions, adding to the market pressure.

Concluding Remarks on Will Bitcoin Rise Again in 2023

What is the recommended approach for Indian investors towards Bitcoin in 2023? Due to the diverse predictions on Bitcoin, it may be best for Indian crypto investors to closely observe its movements rather than taking any risky actions that may lead to significant losses. Experts in the Indian crypto industry also suggest that investors should adopt a cautious approach and wait and watch before taking any further action.

Sathvik Vishwanath, co-founder and CEO of Unocoin, notes that investment sentiment towards Bitcoin is divided. This is due to caution regarding the strengthening US dollar and rising interest rates. He remains confident that Bitcoin will continue to be a popular investment option and that industries will stay interested in its technology. Predicting the future of cryptocurrencies is challenging, but it’s crucial to monitor the effects of rising interest rates and inflation in the upcoming months.

According to Avinash Shekhar, founder and CEO of TaxNodes, crypto investors should make well-informed investment decisions by formulating an investment strategy based on their goals and targeted returns. They should allocate a pre-decided weight to crypto as an asset class, considering their investment goals. To safeguard their capital, investors should avoid investing large portions of their savings in crypto and instead invest small amounts periodically.