State of Crypto Market: Key Events and Trends in 2019

Table of Contents

The state of the crypto market in 2019 is quite different from the past two years. It has been shaped by the highs and lows of 2017 and 2018. In December 2017, bitcoin hit an all-time high of nearly $20,000. Then it plunged into one of the longest bear markets in 2018.

These extreme events helped stabilize the industry. Meanwhile, new players joined the market, while others left after losses. These changes prepared the industry for what was next. Overall, 2019 is a transitional year.

Cryptocurrency prices and stability

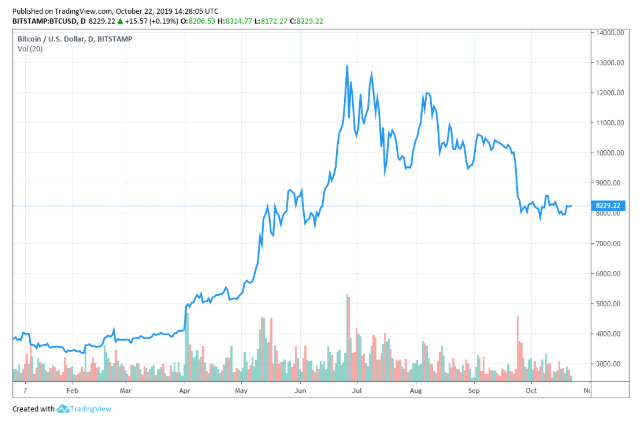

By many standards, the cryptocurrency industry is measured by the price of bitcoin and its fluctuations. After spending the better part of 2018 on a downward trend – with self-proclaimed analysts doubling down on their outrageous predictions – bitcoin started the year trading below $4,000.

This was a far cry from its all-time-high but it fought back throughout the year. On June 26, bitcoin reached its highest price in nearly 17 months. The conversation on the bear market is nearly forgotten as people eye another ride in surpassing the all-time-high. It doesn’t look probable at the time, but with bitcoin, no one really knows.

According to TradingView, bitcoin is 115 percent in the green in year-to-date (YTD) performance.

Bitcoin is up 115 percent in Year-to-Date performance. //Source: TradingView

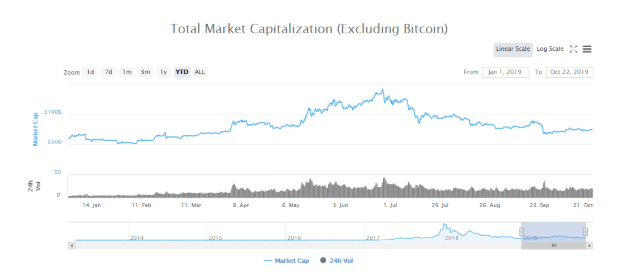

The same cannot be said for altcoins as they are collectively having one of their worst years. Their prices may be doing well against the USD but they are no match for bitcoin. This is even truer as the leading digital asset has managed to increase its dominance to nearly two-thirds of the total market cap.

The entire market cap of the altcoin market has only grown from $60 billion since the first day of the year to its current value of $74.9 billion, CoinMarketCap data shows.

Altcoin market cap 2019. //Source: CoinMarketCap.com

While this was music to the ears of bitcoin maximalists, gold bug and crypto critic Peter Schiff fired warning shots against bitcoin’s rising dominance. He argued, in a tweet, that the collapse of the altcoin market would be followed by bitcoin’s demise.

Facebook’s Libra cryptocurrency

Major companies have, for the last decade, cautiously watched the cryptocurrency revolution unfold.

In June this year, Facebook, the largest social media network with nearly 2.7 billion users, announced its plan to enter the crypto market with a project called Libra.

Before that, Facebook kept its plans secret after announcing in December last year its intention to release a stablecoin for the Indian market.

The state of the crypto market is evolving fast. Projects like Libra—set to launch in May next year—are permissioned cryptocurrencies governed by the Swiss-based non-profit Libra Association. Its founding members include some of the biggest names across various industries.

Libra Association founding members. //Source: Libra white paper

But Facebook’s ambitions were met with hostile governments and regulators who believed that the social media giant’s plans would destabilize the existing financial system. US President Donald Trump took to Twitter to proclaim that he is not a fan of Bitcoin and Libra. He went as far as saying that Facebook should acquire the required licenses if it wants to get into banking.

The pressure got too much and seven of Libra Association’s founding members – Stripe, Visa, Mastercard, eBay, Booking Holdings, PayPal, and Mercado Pago – have quit the project. Whether Facebook’ Libra will see the light of day remains a hotly contested debate.

However, Libra chief David Marcus claims that Facebook will take a different approach rather than give up altogether.

Crypto regulation and the innovation arms race

Facebook’s cryptocurrency project worried governments. They spoke out strongly against Libra and cryptocurrencies in general. Most lawmakers said Facebook must be carefully scrutinized before getting approval. Meanwhile, some countries are working on their own digital currencies.

The People’s Bank of China (PBoC) announced plans to speed up its national digital currency project. This project had been progressing very slowly over the past five years.

Portugal became a darling of the crypto community after ruling that the buying and selling of cryptocurrencies such as bitcoin are tax-free. This comes at a time when the United States taxmen, the Internal Revenue Services (IRS), is cracking down on cryptocurrencies.

Asia continues to be a major hub for the cryptocurrency market. The cryptocurrency market in Singapore is swimming in waters of caution.

A report published by the Washington-based policy institute The Foundation for Defense Democracies (FDD) highlighted that America’s adversaries – China, Russia, Venezuela, and Iran – are turning to cryptocurrencies to dilute US financial dominance thanks to the use of the dollar as the world’s reserve currency.

Crypto under pressure

North Korea added its name to the list. It announced that it is in the early stages of building its own cryptocurrency.

The Financial Action Task Force (FATF) showed its strength in the crypto industry. It enacted new rules aimed at criminalizing so-called privacy coins. Following these rules, the South Korean branch of OKEX delisted privacy coins like Monero, Dash, Zcash, Horizen, and Super Bitcoin. Upbit also removed Monero, Dash, Zcash, Bittube, PIVX, and Haven from its trading pairs.

Block.one, the company behind EOS.io — an Ethereum competitor that raised over $4 billion in its record-breaking ICO — paid a $24 million fine. The fine was to the US Securities and Exchange Commission (SEC) for failing to register its ICO as a securities offering.

Perhaps the most anticipated event of the year was the fate of Bakkt, owned by Intercontinental Exchange. The New York State Department of Financial Services approved Bakkt to offer custody services for physically delivered bitcoin futures.

Crypto is still a crime magnet

It will take a while before criminal activities are eliminated from the crypto space. And this year is no exception. Crypto intelligence firm CipherTrace estimates that the crypto community – investors, exchanges, and users – have lost approximately $4.3 billion through illegal activities ranging from hacks to exit scams.

Binance, one of the leading cryptocurrency exchanges, lost 7,000 bitcoins through a hack, prompting the exchange’s CEO Changpeng Zhao to call for Bitcoin blockchain re-organization. The suggestion was not well received by the community and after cooling down, Zhao apologized for the statement.

The state of crypto market in 2019 was marked by significant challenges, with CipherTrace labeling it “The Year of Exit Scams” after investors lost nearly $2.9 billion in a suspected exit scam perpetrated by South Korean exchange Plus Token. This followed $195 million lost in the QuadrigaCX scandal earlier that year.

Final thoughts

By some measures, 2019 has been a positive year for crypto. One of America’s leading banks, JP Morgan, launched its own in-house stablecoin in February although its CEO Jamie Dimon has a history of bashing bitcoin.

In the evolving state of crypto market, Tron founder and CEO Justin Sun paid $4.6 million to have a charity lunch with legendary investor and bitcoin critic Warren Buffett, but it never happened.